Week In Review: Reverse Cliff Effect. 7 May 2021

Week In Review: Reverse Cliff-Effect

US equity indexes were mixed on the week: DJIA 2.7%, S&P 500 1.2%, NASDAQ -1.5% as value stocks outperformed growth/technology stocks.

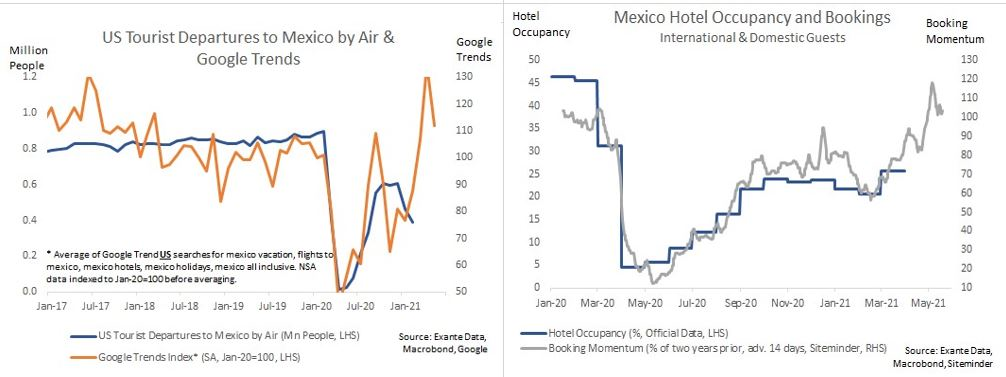

As vaccination rates increase and economies re-open, we are tracking tourism closely at Exante Data. Here, we look at Mexico, which is seeing an encouraging trend – alternative data show Mexican tourism has strengthened past 2019 levels. Strategist Martin Lynge Rasmussen, who is tracking the data, says, “Mexico has seen Google search interest in the US – which account for the majority of inbound tourists – move well past pre-pandemic levels. This suggests that Mexican arrivals from the US could have have exceeded 2019 levels (0.8m people per month) and hit or exceeded 1m arrivals starting in March. The picture from Mexican hotel bookings is similarly encouraging: hotel bookings have moved past 2019 levels, though there has been a slight pullback recently. The share of hotel bookings made by foreigners (57% in April and 58% in May so far) has exceed pre-pandemic levels (45-50%).” We would add that a still encouraging COVID trend (different from rest of Latam) and more positive news around vaccine supply (including Pfizer deliveries from US production sites) should further reduce tail risk around a fresh wave of Covid in Mexico.

USD Comment

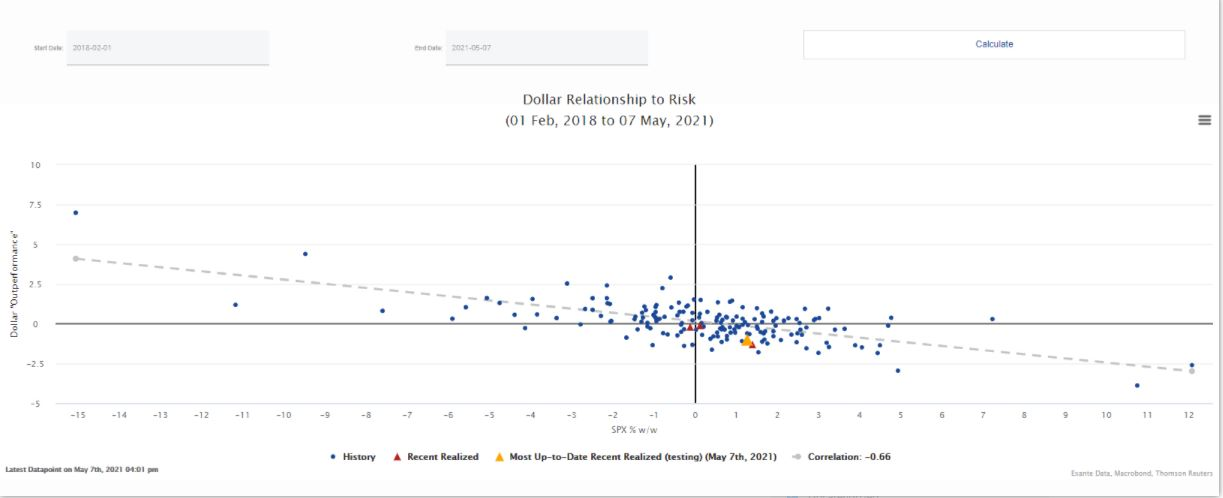

The USD had another strong bout of underperformance. The last four weeks have exhibited USD underperformance beyond what could be explained by moves in the equity market. This week, the gap is about -90bps (chart below, yellow dot)

The DXY Index ranged 91.42-90.20. USD weakened on Friday on the big US payroll miss to the downside for the April result: +266k actual vs approximately +1million expected by the consensus. However, the DXY Index remained above key 90.00 support. EURUSD pushed well above 1.2100 on Friday’s weaker than expected US payroll read. The single currency ended the week at 1.2164. Similarly, GBPUSD, which had been in a tight range all week, rose about a big figure over the course of the day on Friday. GBPUSD high was 1.4004 and the catalyst was the payroll read. USDJPY ranged 109.68-108.49, with the low on Friday. Commodity currencies also strengthened on Friday as the USD weakened.

Coronavirus Update: Reverse Cliff-Effect

Chart: 2021 US and EU Vaccine Production (billion doses) noting excess production/exports

Exante Data Happenings & Media

Head of Asia Pacific, Grant Wilson, has a new opinion column out in The Australian Financial Review: New Zealand’s engagement with China is clear-eyed. “The Ardern government has every right to pursue New Zealand’s national interest in engaging with China. Its stance on Five Eyes is smart and principled, and not merely self-serving.”

Adam Tooze gave Exante Data a shout out during his appearance on Bloomberg’s Odd Lots podcast. We were mentioned as a provider of very-fast number crunching/analytics during the pandemic. You can listen to the podcast here for Adam’s insights on what an extraordinary year 2020 was.

We recently initiated tracking of flows related to bunds on our data and analytics platform and have added the Buba balance sheet data.

How to reach us:

- Our Substack is public – Join us in discussing and debating macroeconomic topics – Subscribe here.

- If you are an institution and would like more information on our Macro Strategy, Global Flow Analytics, Exante Data API services, our Digital Currency Series, and/or our Covid research — please reach out to us here